HealthShares: An Affordable Strategy for Small Business Benefits

Across the country, the challenge of affording quality health benefits is a common struggle for small business owners. For those with a limited number of employees, providing comprehensive health insurance can understandably feel financially daunting.

In This Article

Facing this reality, some have turned to alternative options when traditional health insurance turns out not to be a viable option. One solution that is gaining traction among small businesses, and one that Planstin uniquely builds into its benefits, is HealthShare membership—a less-known but growing health insurance alternative.

This approach has been key for many small businesses, allowing them to offer benefits at a fraction of the cost of traditional insurance. In certain industries or business types where an employee would rarely expect to receive benefits, adopting this model has set some businesses apart from others, providing much-needed support for their employees at far lower costs than standard insurance premiums.

The cost of annual health insurance premiums have increased by 47% in the last decade, reaching $23,968 for a family in 2023.

Compared to the rising premiums of health insurance, medical cost sharing organizations like Zion HealthShare offer more affordable options, often resulting in savings of 40-60%. There are lots of entrepreneurs out there looking for the best small business health insurance, and this alternative should catch their eye.

Catastrophic healthcare and small business benefits

HealthShares are organizations which take a community-based approach to managing large healthcare expenses. Though many tend to think of them as similar to insurance, they differ fundamentally in their structure and practices.

Unlike conventional insurance, where a company collects premiums to cover the healthcare costs of its policyholders, HealthShares involve a group of individuals contributing to a pooled fund that is managed by the organization and distributed to community members’ eligible medical expenses.

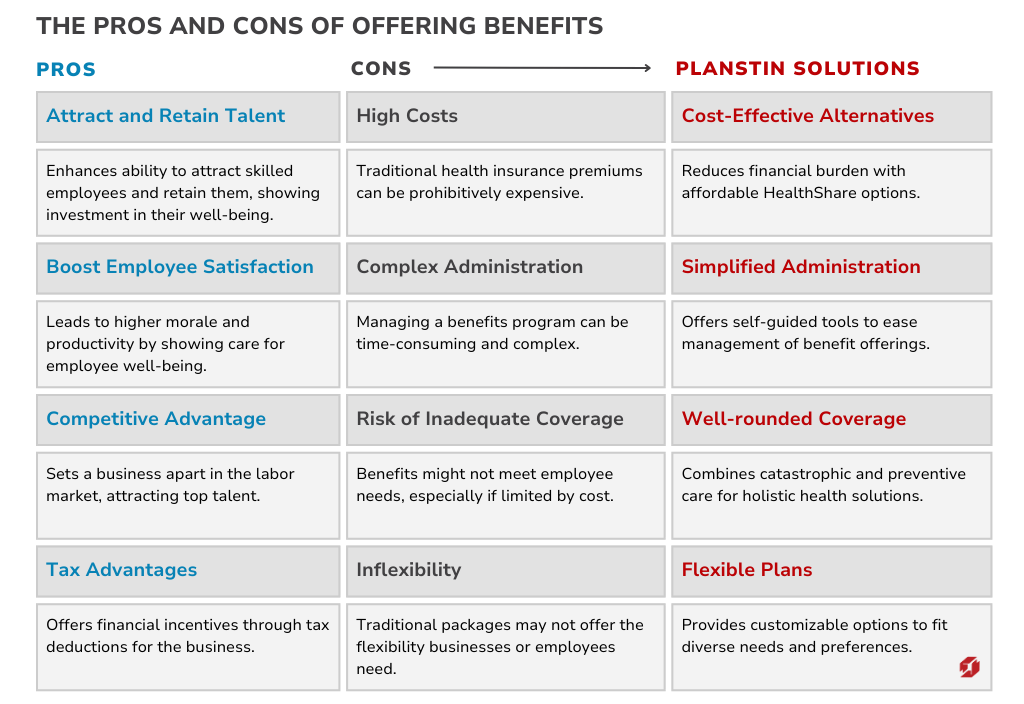

Small businesses that offer benefits often cite improved employee morale and the ability to attract and retain quality workers as significant advantages.

Also, unlike insurance, the main focus of HealthShare membership lies in addressing more catastrophic medical events, offering a mode of relief for large, unexpected healthcare costs that can be burdensome for people to bear alone.

Understandably, this emphasis on catastrophic care can raise concerns about routine and preventive healthcare expenses, areas typically covered by traditional health insurance. Critics often point out that while HealthShares effectively support members during major health crises, regular medical services like preventive care, routine checkups, and prescriptions, are paid by members out of pocket.

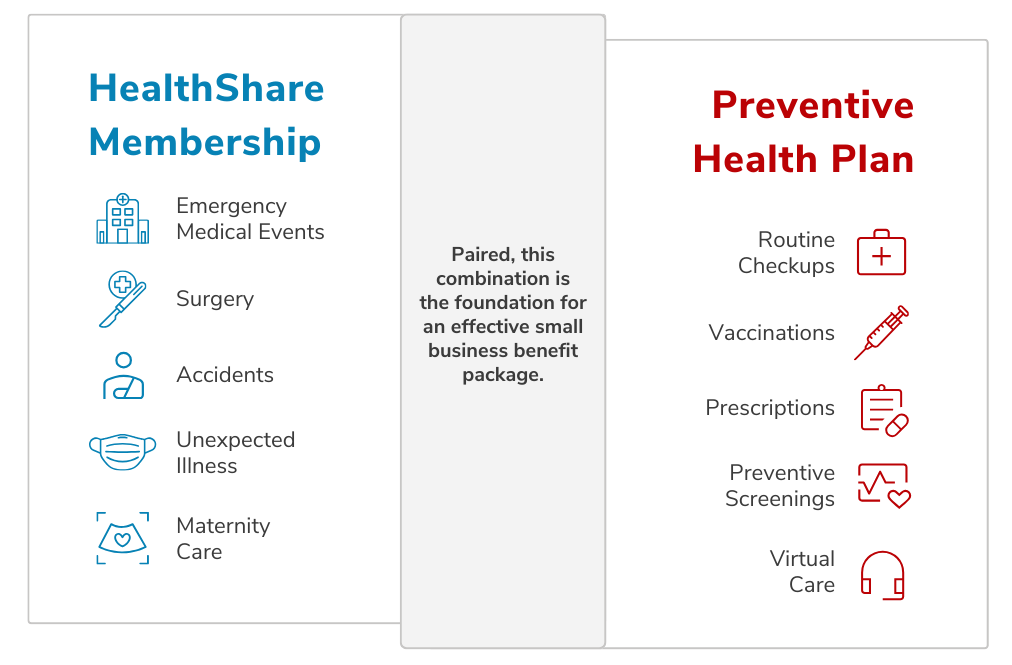

Addressing these concerns, companies like Planstin have created unique solutions, combining HealthShare membership with additional benefits that feature preventive care. The unique combination of Planstin’s Preventive Suite of health plans with HealthShare membership is specifically designed to bridge this gap. This combination not only facilitates the sharing of funds for major medical events, but also provides affordable access to preventive care, prescriptions, and more modern services like telemedicine. It is this type of alternative solution that makes benefits viable for small businesses, combining the low-cost insurance alternative in HealthShares with affordable services to create a well-rounded healthcare experience.

Low costs and high retention rates with HealthShares

As pointed out already, integrating HealthShare membership into an employee benefits package is a much less expensive prospect for a small business than traditional health insurance. We at Planstin have taken this even further by building self-guided tools that business owners can use to manage their own benefit offerings. They can make changes, invite employees, and set contribution levels for employee plans. It is worth noting that even in scenarios where employers opt not to contribute, employees still find themselves facing much lower costs than with insurance options.

The positive impact of Planstin’s HealthShare-oriented benefits packages on employee retention cannot be overstated. A survey by WTW found that 60% of employees feel their healthcare plan is an important reason to stay with a current employer. Could your business use a low cost health insurance alternative that will keep your best employees happy?

A survey by WTW found that 60% of employees feel their healthcare plan is an important reason to stay with a current employer.

Small business benefits are within reach

Many small business owners do not think that benefits are a viable option for them, having unsuccessfully looked for affordable health insurance for small business and not realizing other options exist. Only 38% provide benefits, with this figure decreasing further among businesses with smaller revenues. For instance, a survey by Paychex found only 22% of businesses earning less than $500,000 report offering benefits. This small business reluctance to offer benefits most often stems from financial considerations and the lack of a legal mandate for businesses with less than 50 employees.

Despite this, the value of offering benefits, particularly healthcare, is widely recognized. Small businesses that do offer benefits often cite improved employee morale and the ability to attract and retain quality workers as significant advantages. While it is no surprise that small businesses with smaller budgets would be reluctant to offer expensive insurance, we at Planstin think the potential for alternative solutions like our Preventive Suite health plans that integrate HealthShare membership offer a viable, value-driven healthcare option for small businesses and their employees.

Why are businesses choosing to offer or not offer benefits?

For large businesses, offering benefits to employees is almost a given, mainly due to legal requirements that levy fines against those that don't. Small businesses, on the other hand, tend to see benefits as a luxury they can't afford yet, generally opting out due to perceived financial constraints. But with Planstin's solutions to small business benefits concerns, we can make benefits packages affordable and possible for your business.

What small businesses might want to know about HealthShares

For small business owners considering a HealthShare-anchored benefit solution, there are usually a couple common concerns we address:

Are HealthShares dependable in their paying medical bills?

When you are dealing with a reputable company with clear sharing guidelines, absolutely! In designing our benefits, Planstin collaborates with Zion HealthShare, the most highly rated and fastest growing HealthShare organization available. Zion’s clear guidelines and strong track record offer reassurance about their resolve to support the needs of their members.

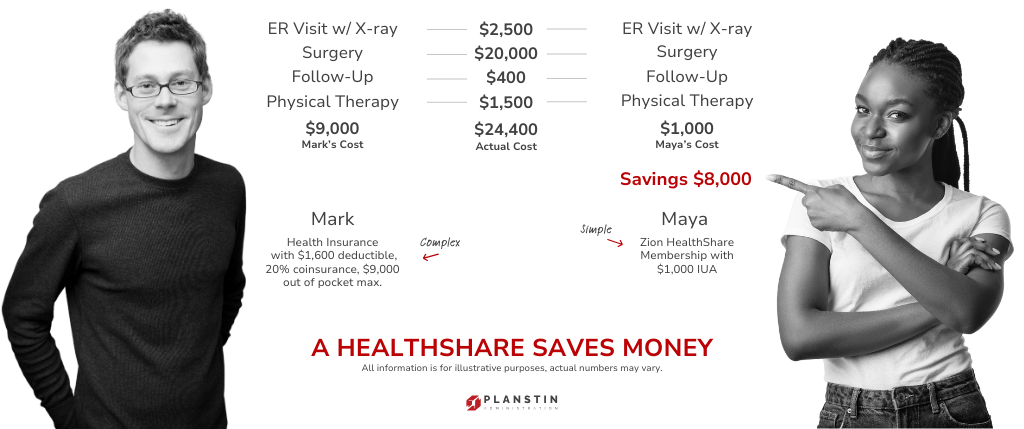

How does the IUA (initial unshareable amount) work?

Many members liken the IUA to a traditional insurance deductible: it’s what members are responsible for paying before the shared funding kicks in. For a simple illustration of how a HealthShare IUA works and saves you money, see the graphic below comparing two people’s costs related to a broken leg.

As illustrated above, Maya’s $1,000 IUA was her responsibility to pay toward medical costs for this injury. The rest of the funds necessary were shared by the HealthShare community, creating a savings scenario for Maya that is hard to ignore.

Are the options robust enough to meet people’s needs?

When big savings often mean a compromise of quality, access, or convenience, this concern is certainly understandable. With a HealthShare membership alone, specific benefits commonly provided by traditional insurance might be absent, like regular and routine care such as checkups, maintenance medications, and preventive care.

This is where Planstin comes in.

Our packages combine HealthShare membership (for larger catastrophic needs) with a collection of preventive-focused products to create well-rounded and unified health benefits that are equipped to meet the diverse needs of your workforce.

The preventive health plan component of this strategy is designed to cater to smaller medical needs like checkups, prescriptions, and other routine care. Members can enjoy these services while knowing that they have a HealthShare membership in their pocket for the larger, unforeseen medical expenses.

By combining these benefits you can offer your employees an affordable, well-rounded benefits package that gives them access to the care they need at a price point you can afford.

HealthShare Membership and a Preventive Health Plan pair up to make an effective benefits package for small businesses.

Are you a small business owner looking for a small business benefits package?

Discover how Planstin and Zion HealthShare are redefining benefits with HealthShare memberships for employees.

Explore

SUGGESTED FOR YOU

I WANT TO...

LOGIN

CLAIM INFORMATION

Payer ID: 65241

Planstin Administration

P.O. Box 21747

Eagan, MN 55121

© 2023 Planstin Administration - All Rights Reserved