Understanding Section 125 Premium Only Plans (POP): A Guide for Business Owners

Understanding Section 125 Premium Only Plans (POP) is crucial for any business looking to maximize their tax savings and remain competitive in the hiring market. This helpful guide provides an overview of Section 125 POPs, why you should have one, how they work, how to avoid common errors, and how Planstin can help you navigate your plan.

In This Article

Key Insights

- A Section 125 Premium Only Plan legally allows you to reduce taxable income by deducting employee health premiums pre-tax.

- Your POP must be formally drafted and adopted to comply with IRS regulations.

- Section 125 POPs have strict rules on what is and isn’t eligible for deduction.

- Almost any business can offer a Section 125 POP, but not all employees may be eligible to participate.

- Due to complex regulations and compliance concerns, it’s best to seek help from a professional, like a CPA, to ensure your Section 125 POP is set up and maintained properly.

What is a Section 125 Plan?

A Section 125 Plan, often known as a Cafeteria Plan, is a written plan that allows employees to pay for certain out-of-pocket expenses, like health insurance premiums and medical costs, with pre-tax dollars. These plans are named after the section of the IRS Code that governs them and nicknamed for the flexibility they can offer in how employees receive benefits and compensation.

Nearly any business, regardless of size, can set up a Section 125 Plan. To offer this benefit, you must have a Section 125 document, which serves as the backbone of the plan, outlining the specifics and ensuring compliance with tax regulations.

Why was Section 125 created?

Section 125 was added to the Internal Revenue Code (IRC) in 1978 (and has been amended many times since) with the aim of encouraging businesses to offer employee benefits. The addition was also meant to increase the affordability and accessibility of health benefits.

What is a Section 125 Premium Only Plan?

A Premium Only Plan (POP) is the most common Section 125 Plan. A POP allows employers to deduct health premiums from employee paychecks before taxes—something that many employees consider a given with workplace benefits. This type of plan may or may not also include a cash-in-lieu provision which allows employees to choose a taxable cash payment instead of opting-in for health benefits.

A Section 125 Plan, often known as a Cafeteria Plan, is a written plan that allows employees to pay for certain out-of-pocket expenses, like health insurance premiums and medical costs, with pre-tax dollars.

What can a Section 125 POP cover?

As its name suggests, a Premium Only Plan is designed to cover healthcare premiums. This means that coverage is limited to traditional health coverage items like health insurance, dental, vision, and other qualifying health plans. Nontraditional and supplemental options are typically not eligible* for the pre-tax treatment of a POP.

As an example, here is a list of benefits offered by Planstin separated by whether or not they are eligible for a Section 125 POP.

*Note: Consult one of our benefit administration professionals if you have questions about Section 125 POP compliance. Our team is available to assist at 888-920-7526.

Compliant (pre-tax) health benefits

- Preventive Series

- Care+ Series

- Standard & Enhanced Dental

- Standard Vision

- HSA Contributions

Post-tax health benefits

- Planstin Accident

- Giving Accident Indemnity

- Giving Hospital Indemnity

- Giving Critical Illness

- Standalone Amaze Health Membership

- HealthShare Membership

Who can participate in a Section 125 Plan?

Most employees, whether full or part time, can benefit from a Section 125 POP—so long as they are not in one of the groups that the IRC prohibits from participating. For example, in a Sole Proprietorship, the proprietor and their family members may not participate. Other nondiscrimination rules would prohibit high-earning employees, and employees that are more than 2% shareholders.

Other than the IRC participation regulations, businesses may choose to establish their own participation requirements, such as a certain length of service at the company.

How you benefit

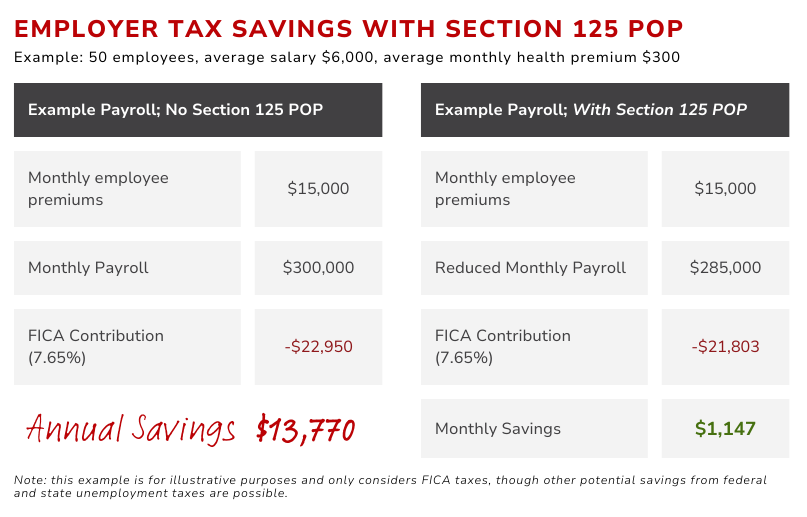

The primary, and maybe most obvious benefit of a Section 125 Plan for employers is the tax savings. By reducing employees’ taxable income, employers may see significant payroll tax savings. However, there are related benefits to these savings.

Tax Savings

Contributions made by employees are deducted from their salaries, ultimately reducing the employer’s payroll taxes.

Attract and Retain Talent

Enhanced benefit packages make your company more attractive to current and potential employees. Offering a Section 125 Plan may end up being an effective pay raise for employees who opt to participate (a pay raise that may ultimately save your business money).

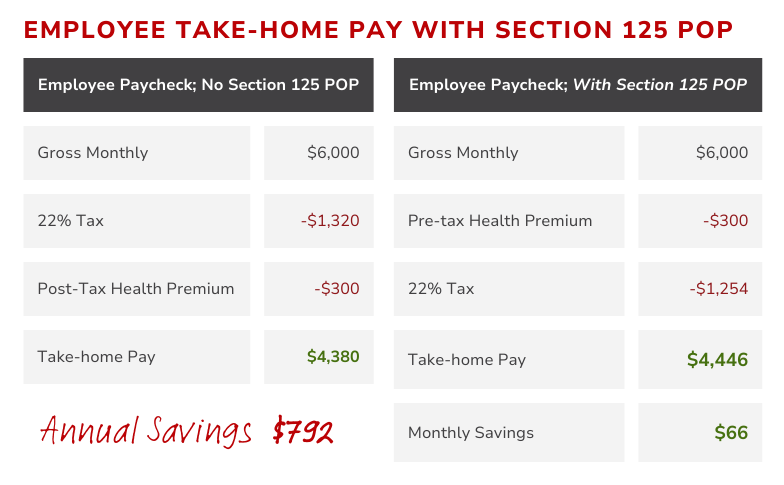

How your employees benefit

For your employees, enrolling in a Section 125 Premium Only Plan should be nearly effortless. You will present them with the choice to opt in or out of the program, and after they make their choice, your payroll process will do the rest. Once they opt in, the employee will enjoy the benefits of the pre-tax deductions of their health benefits.

Reduced Taxable Income

Employees’ premiums are now paid pre-tax, which reduces their taxable income.

Increased Take-home Pay

With less money taken out for taxes, your employees will see more money in their pockets throughout the year.

Starting and managing your Section 125 Plan

Running a Section 125 Plan can be relatively painless, particularly if you are working with a Third-Party Administrator (TPA) like Planstin. Your TPA can help you through each stage of the process and ensure your plan remains compliant after it is established. Listed below are all steps Planstin can help you through.

1. Draft a Written Plan Document

We will help you outline your plan, the benefits offered, and the rules that will govern your plan.

2. Formally Adopt the Plan

You’ll make it official with a resolution or similar formal action.

3. Communicate with Your Employees

We will make sure your employees know about your plan and how it works. Typically, this is done when you provide the Summary Plan Description (SPD) prepared by Planstin. Your employees will also be presented with the choice to opt out or choose a cash payout in lieu of benefits.

4. Comply with Nondiscrimination Rules

We will help ensure your plan is in line with Section 125 nondiscrimination guardrails, which are designed to prevent your plan from favoring some employees over others.

Section 125 Nondiscrimination Basics

- Eligibility – employees other than highly compensated employees (HCEs) must be eligible for your plan.

- Benefits and Contributions – all participants must be able to elect the same benefits and amounts.

- Key Employee Concentration – benefits for key employees cannot exceed 25% of the total for all employees.

- Utilization – HCEs should not be taking disproportionate advantage of the plan.

For detailed rules read more here.

5. Report to the IRS

Section 125 plans are subject to ERISA, and thus may require filing Form 5500, an annual report filed with the DOL and IRS that provides information about your benefit plan’s financial condition and operation.

You may need to file Form 5500 for your Section 125 plan if

- Your plan has more than 100 employees participating

- Your plan offers a Flexible Spending Account

- Your plan offers group-term life insurance

You do not need Form 5500 for your Section 125 plan if

- Your plan has fewer than 100 employees participating

- Your plan is a POP Section 125 plan

6. Review and Update as Needed

We will also make sure your plan stays up to date with both legal regulations and your employee population. Adjustments may need to be made as often as every year.

Common Section 125 mistakes to avoid

As common as Premium Only Plans are, mistakes are still possible, especially without expert help. Since even small oversights could lead to significant issues, you’ll want to be aware of some of the common pitfalls. Of course, Planstin is here to not only educate you about these pitfalls, but also to make sure you don’t get caught in any of them.

Not Having a Written, Compliant Section 125 Plan

This first one may seem obvious; however, many employers may not realize that pre-tax payroll deductions for health benefits need to be made official with a written Section 125 POP that adheres to the regulations laid out by the internal revenue code.

If you have a payroll service and trust that they have taken care of this for you, you may want to think again. A Section 125 plan is your responsibility to set up. And you will be the one on the hook for any penalty for noncompliance, not your payroll company. The plan must be in writing, and it must be formally adopted.

Failure to Update Plan Documents

Setting up your Premium Only Plan is not a one-and-done. Like many things regulated by complex policies, regular updates may be needed to reflect changes in legislation, company policy, and employee population.

Noncompliance with Non-Discrimination Rules

This is not a step to skip. Section 125 Plans must be equitable, and you must be able to prove that they are. Those reports about your non-discrimination tests should be kept internally in case you need them.

Poor Communication with Employees

Part of the requirements for Section 125 plans is that you provide detailed information to your employees. Section 125 is built on the idea of giving employees an option. So, no matter which type of Section 125 plan you offer, your employees must be able to opt in or out with a full understanding of what is being offered to them.

A POP allows employers to deduct health premiums from employee paychecks before taxes—something that many employees consider a given ... however, many employers may not realize that pre-tax payroll deductions for health benefits need to be made official with a written Section 125 plan.

Dangers of noncompliance

Have you been deducting employee benefit contributions pretax without a written Section 125 plan? Or do you have a written plan, but you’ve skipped one of the other important steps, like adequately informing your employees of their options? Now is the time to course correct. If your Premium Only Plan does not follow the Section 125 rules, you and your employees may be at risk.

Tax Penalties

Your business and your employees could face penalties for underpayment, back taxes, and interest. Correcting this issue retroactively can be complex and might not always be possible, which could lead to a loss of tax benefits for previous periods and plan disqualification.

Plan Disqualification

If your Section 125 plan isn’t set up right, you could lose the ability to offer one, resulting in loss of tax benefits for everyone involved.

Legal Challenges

Failure to comply with IRS rules could lead to audits, legal challenges, and refiling, further complicating your situation.

Planstin’s hassle free, $0 fee Section 125 plan

Implementing a Section 125 Premium Only Plan is a strategic move to elevate your benefits offering while balancing your budget. However, your plan’s success will depend on how well you understand the complexities and comply with detailed regulations.

Working with a Third-Party Administrator like Planstin Administration can help you navigate the intricacies of establishing and maintaining a Section 125 plan and effectively communicate with your employees for maximum participation (and thus, maximum savings).

We know how critical a Premium Only Plan can be to your business’s success, which is why we automatically provide Section 125 documents, at no extra charge, for our clients (a service that can typically cost anywhere from $100-$600).

Our complimentary Section 125 service ensures compliance, accuracy, and timeliness, allowing you to focus on running your business.

Reach out to Planstin today and take the first step toward optimizing your budget, boosting your retention, and simplifying your benefits administration.

Legal disclaimer: This is not legal advice. For questions regarding your specific situation, please consult an attorney.

Explore

SUGGESTED FOR YOU

I WANT TO...

LOGIN

CLAIM INFORMATION

Payer ID: 65241

Planstin Administration

P.O. Box 21747

Eagan, MN 55121

© 2023 Planstin Administration - All Rights Reserved