Self-funded Benefits: What Are They?

When you think of benefits, you may think strictly about the health insurance options offered to you by your employer—or if you are the employer, you may think about the benefit options you make available for your employees.

Benefits like dental, vision, and health insurance are common employer offerings especially when a company has over 50 employees. However, whether your company has 50 or 500 employees, another approach may work better for your employees and your bottom line: self-funded benefits.

What are self-funded benefits?

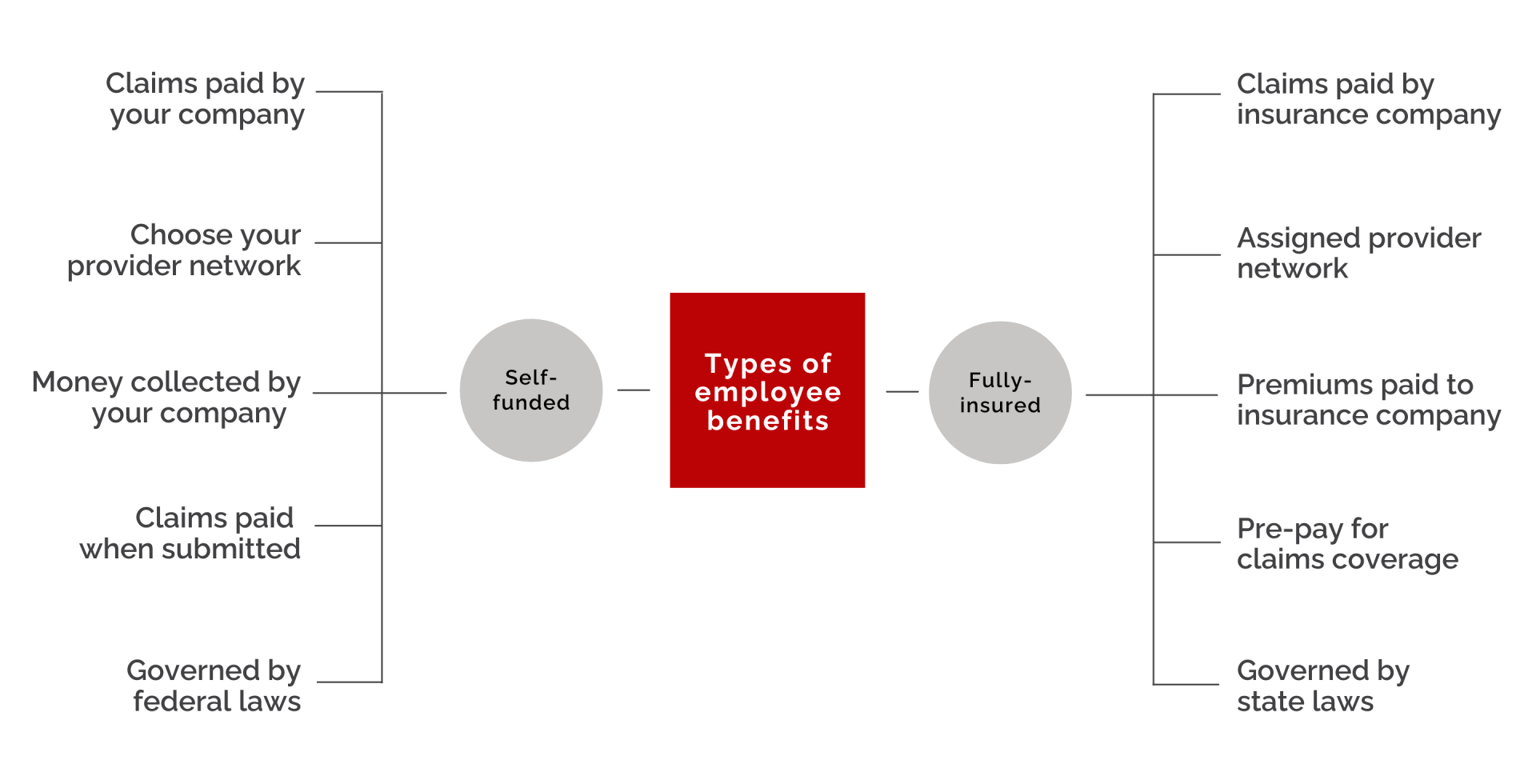

Self-funded benefits or self-insurance is an alternative to traditional fully-insured plans. Self-funded benefits are a type of plan where the employer “takes on the responsibility of paying employees’ and dependents’ medical claims.” As with a fully-insured plan, the funds for the plan may come from both the employer and the employees. However, the employer takes on the responsibility for their employees’ healthcare benefits instead of paying an insurance company to handle their employees’ healthcare benefits.

When a company decides to self-fund, they will generally set up a trust fund (specifically for employee healthcare) where funds will be collected and distributed from whenever insurance claims are submitted. Since healthcare claims can be unpredictable, self-insured companies, particularly smaller ones, will obtain stop-loss insurance coverage to help absorb exorbitant claims. This way, a self-insured company can provide customized benefits for their employees at a more reasonable price, while still protecting themselves from catastrophic costs.

What are the regulations?

Self-funded benefits are not regulated the same as fully-insured benefits. When a company decides to self-fund, they are not required to comply with state insurance laws for medical benefit plan administrators. Rather, they are obligated to comply with certain federal regulations that include

- the Employee Retirement Income Security Act (ERISA),

- HIPPA,

- COBRA, and

- the Americans with Disabilities Act (ADA).

Self-insured companies are also obligated to generate a Summary Plan Description (SPD) for their employees.

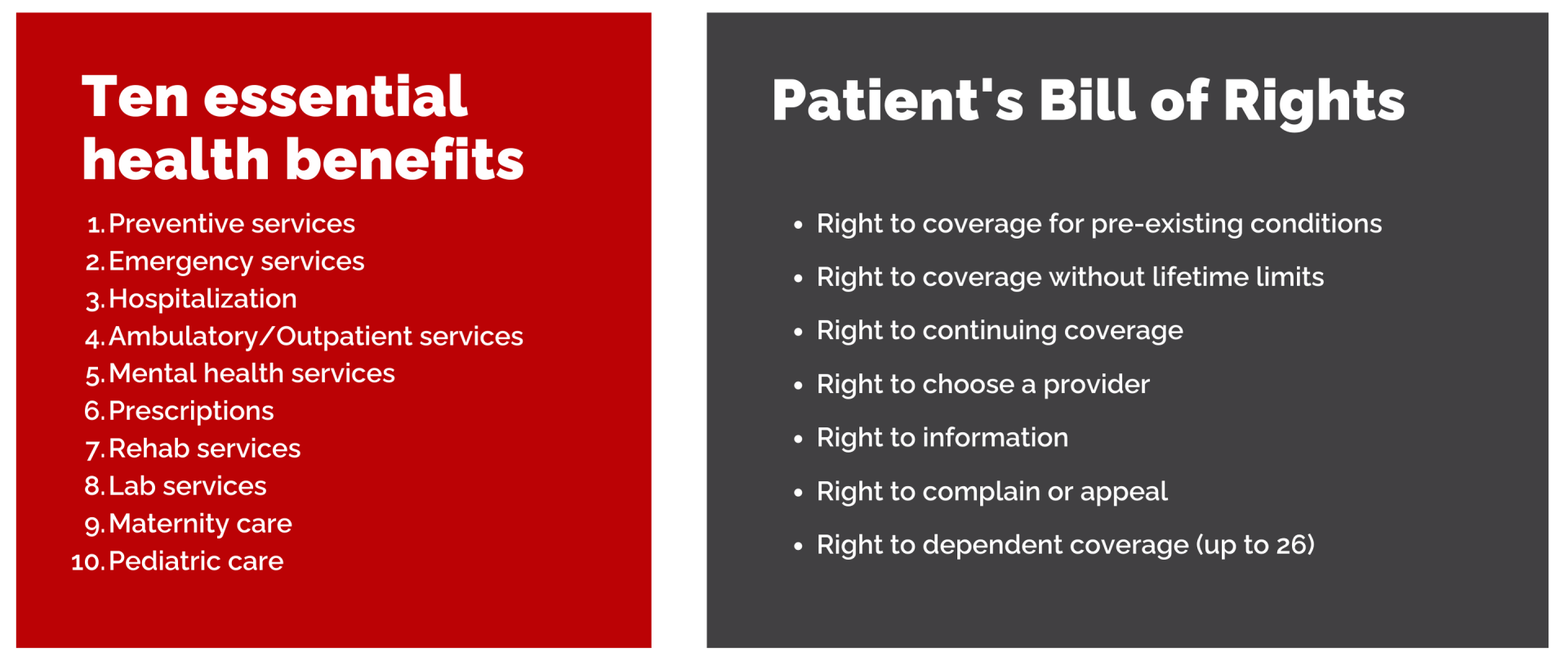

Though self-funded plans are subject to select federal regulations, they do not need to comply with some parts of the ACA like the ten essential health benefits requirement and premium increase reviews. On the other hand, all self-funded plans are required to comply with other provisions of the ACA like adhering to the Patient’s Bill of Rights and providing things like preventive care and coverage for pre-existing conditions.

The regulations that govern self-insurance provide employees with confidence that they will receive important coverage while simultaneously providing employers with the flexibility to offer benefits that best suit their specific company needs.

Why choose self-funded benefits?

Employers traditionally offer benefits that are fully-insured—or that are purchased from and administrated through an insurance company like Aetna, Blue Shield, or UnitedHealthcare. In these scenarios, the employer pays the insurance company for healthcare coverage for their employees. Of course, the employer pays a set amount no matter how much the employees use their benefits. These premiums are not cheap, and employers can end up paying for a lot of services that their employees may or may not use.

In an attempt to pay for what they actually use, employers may opt to self-fund their benefits packages. In the past, this has been more common with large corporations, since larger companies are generally in a better position to handle the burden of costly claims. However, self-funded plans are becoming more and more popular for even small companies.

A small or mid-size company might prefer a self-funded plan for the following reasons:

- No pre-payment for coverage; only pay when claims are submitted

- Not subject to state regulations; self-insurance is federally regulated I

- Fewer extra costs (e.g. no state premium taxes)

- Don’t pay for insurance company profits

- Contract with the provider network of your choice – reflecting your employee population.

Using a third-party administrator

When a company uses a traditional insurance plan, they benefit from the administrative capacity of the insurance company that they work with. Without that assistance, self-funding a plan can be a lot of extra work, and it can strain limited company resources. That is why many companies who want to self-insure may end up working with a third-party administrator (TPA). Though self-funded plans can be totally autonomous, where the company handles the administration of the plan in-house, those who choose to work with a TPA will get help with:

- Reporting

- Adjudicating claims

- Lowering overhead costs

- Consolidating billing for providers

- Accessing a reputable provider network

- Remaining compliant with federal regulations

Overall, a TPA helps by taking on the administrative burden of funding your own benefit plan. By using a TPA an employer can conserve the resources of their HR and finance departments, allowing the TPA to take responsibility for managing the benefit plan.

Summary

Self-funded benefits allow you the opportunity to create something truly customized for your workforce. Since you know your employee population, you can provide benefits that your employees need and use and not spend money on benefits that are rarely needed.

If your company decides to go the self-funded route you will have a bit more flexibility than with the traditional insurance route. Though self-funded plans are not as heavily regulated as fully insured ones, there is still a good deal of accountability. Choosing this strategy can give your company an opportunity to save money while still taking excellent care of your employees’ healthcare needs.

Legal disclaimer: This is not legal advice. For questions regarding your specific situation, please consult an attorney.

Explore

SUGGESTED FOR YOU

I WANT TO...

LOGIN

CLAIM INFORMATION

Payer ID: 65241

Planstin Administration

P.O. Box 21747

Eagan, MN 55121

© 2023 Planstin Administration - All Rights Reserved