What Is a MEC Plan?

Since the Affordable Care Act (ACA) went into effect, there has been a lot of talk about Minimum Essential Coverage (MEC). But, what really constitutes minimum essential coverage, and what does it mean when a plan is MEC-compliant or advertised as a MEC plan?

ACA mandates

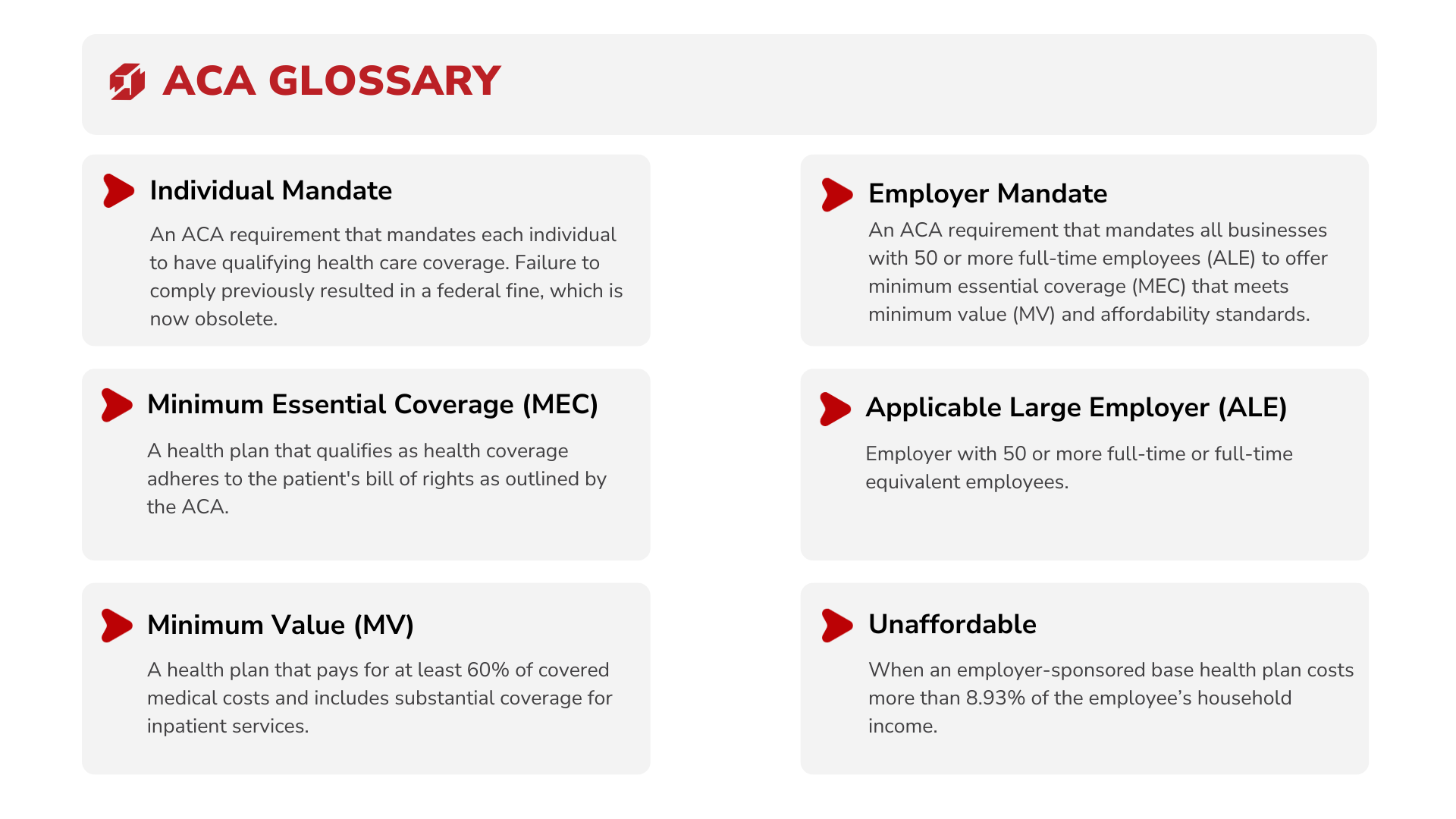

Many people are familiar with the ACA’s individual mandate (individual shared responsibility requirement) that requires each individual to have qualifying health coverage, or minimum essential coverage. An individual may obtain this kind of coverage with an employer-sponsored plan, an individually-purchased plan, or a government-sponsored program. Up until 2019, an individual without qualifying coverage would be fined by means of a tax penalty. While that federal tax penalty has since been repealed, some states do still impose a fine.

The ACA also includes an employer mandate. This mandate is still in place for applicable large employers (ALEs) that have a workforce of 50 or more full-time employees, and it requires employers to offer affordable MEC plans that also meet minimum value standards as defined by the ACA. This mandate also requires that at least 95% of a company’s full-time employee population be enrolled in the employer-sponsored health benefits.

Defining MEC

Sorting out exactly what minimum essential coverage is can be tricky because many definitions are vague. For example,

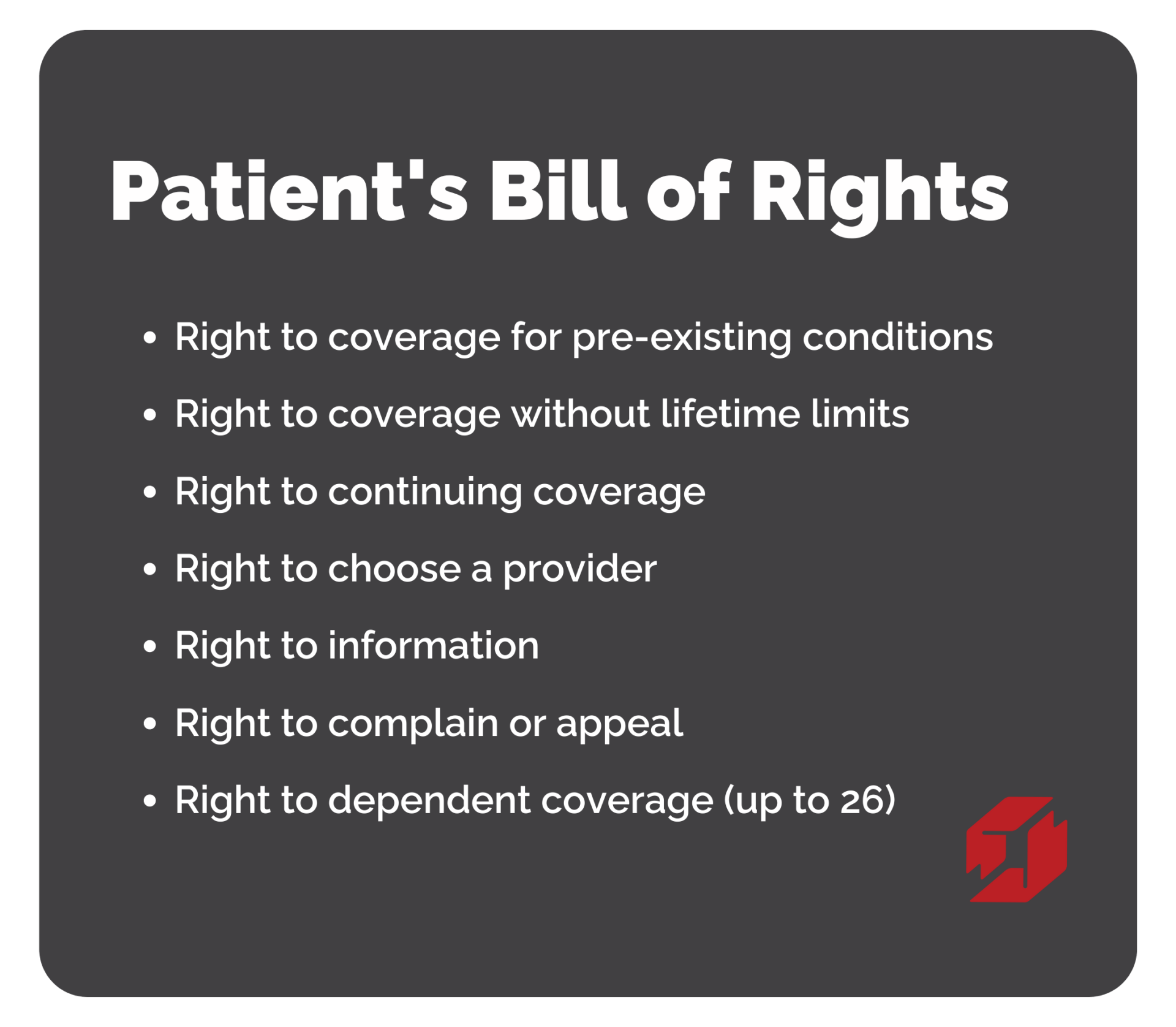

any employer-sponsored coverage qualifies as minimum essential coverage. A MEC plan should also adhere to the ACA’s Patient’s Bill of Rights. The Patient’s Bill of Rights outlines rights that include access to coverage for pre-existing conditions, limits on when an insurance company may rescind or cancel coverage, and coverage without lifetime or annual limits.

A more detailed list of plans that qualify as minimum essential coverage is available here.

ACA Penalties

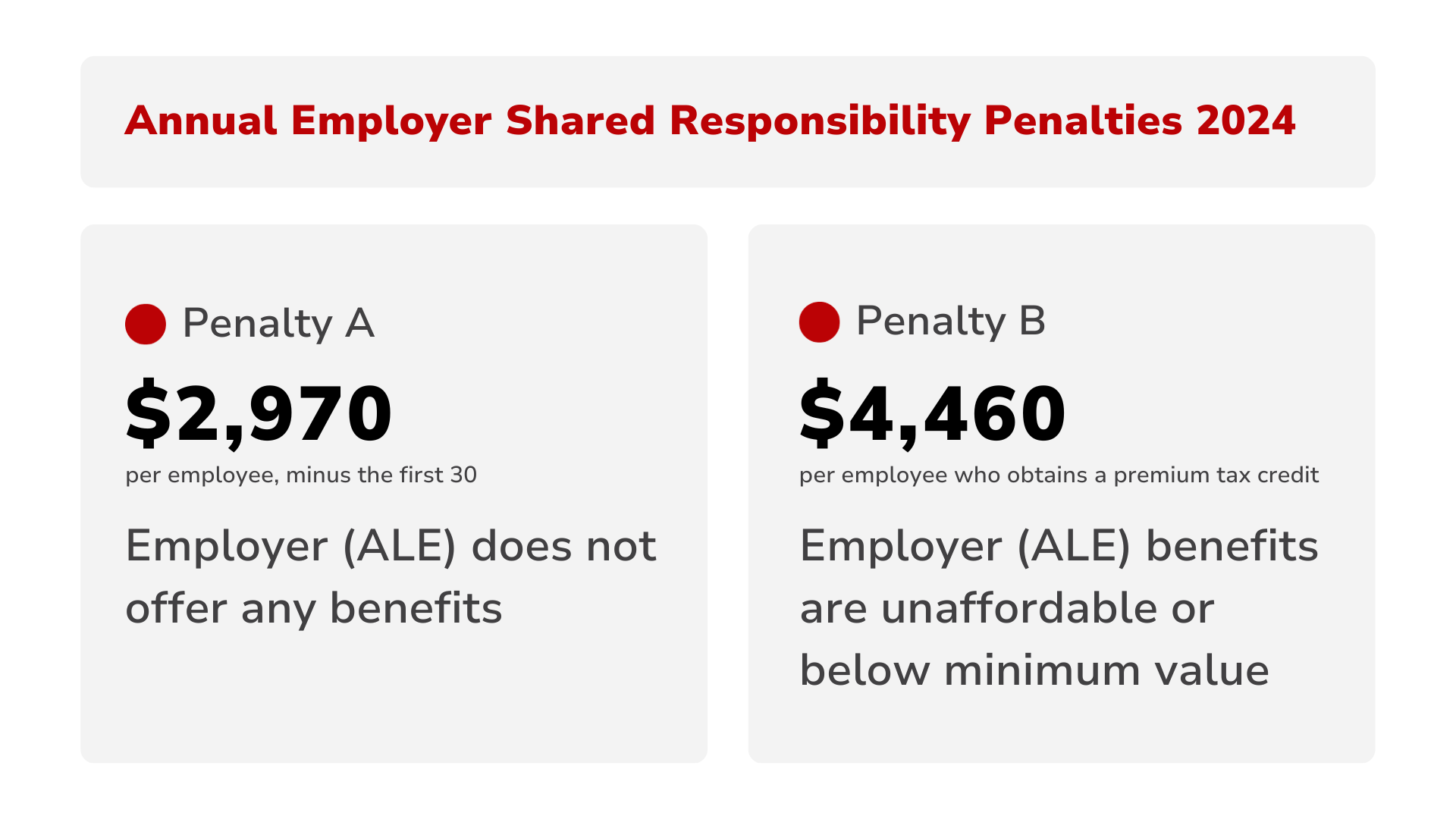

If an ALE does not offer its full-time employees MEC health coverage, they will be penalized. For 2024, in the event that an ALE does not offer any health coverage, they will be assessed a penalty of $2,970 per full-time, or full-time equivalent, employee (minus the first 30). So, for example, if a company employs 200 people full-time and does not offer any health coverage, they will be penalized $504,900 over the course of the year (200-30 x $2,970), or $42,075 monthly ($504,900/12).

In the event that an ALE offers health benefits to its full-time (or full-time equivalent) employees that don’t quite measure up to ACA standards for minimum value (MV) or affordability, the employer is at risk for a different penalty. For any full-time employee who declines employer-sponsored MEC coverage, seeks insurance from one of the marketplaces, and obtains a premium tax credit, the employer will be assessed a $371.67 monthly ($4,460 annually) penalty. If even one employee receives a premium tax credit, the employer will be penalized.

It's worth noting that when an employer does offer benefits, it is far less likely that their employees will seek coverage in the marketplace. So, although an employer’s benefits package may not be affordable or measure up to the ACA’s minimum value standards, the penalty is only assessed if an employee declines employer-sponsored benefits, seeks coverage in the marketplace, and qualifies for a premium tax credit.

In the first scenario, the penalty is automatic, and very costly. In the second scenario, the penalty is assessed on a case-by-case basis. If the employer-sponsored plan is robust enough, employees may be satisfied with it, and a penalty might not be an issue.

How Planstin works with MEC

Planstin specializes in helping companies offer customizable, MEC plans that help businesses comply with ACA requirements. Additionally, Planstin’s MEC plans are affordable and easy to use. With Planstin, you can offer an ACA-friendly, MEC-compliant plan for as low as $35 per employee. These MEC plans will help you save money by avoiding tax penalties, retain more employees, and attract top talent. If you are curious about how this can work for your company, you can set up a complimentary virtual meeting and get a free quote tailored to your business needs.

MEC and small business

What if a company has less than 50 full-time equivalent employees? In that case, they are not subject to the same ACA requirements, and “no small employer…is subject to the Employer Shared Responsibility Payment.” However, a small business may still wish to offer MEC-compliant plans since the concept behind minimum essential coverage is important. There are also potential benefits for any small business (under 50 full-time employees) that offers a MEC plan.

The ACA set up the Small Business Health Options Program (SHOP) which, when enrolled, may allow a small business to qualify for a tax credit.

This is not legal advice. For questions regarding your specific situation, please consult an attorney.

Explore

SUGGESTED FOR YOU

I WANT TO...

LOGIN

CLAIM INFORMATION

Payer ID: 65241

Planstin Administration

P.O. Box 21747

Eagan, MN 55121

© 2023 Planstin Administration - All Rights Reserved