Employee Benefits 101 for Small Business Owners

While the employee benefits industry can seem overwhelming and complicated, it doesn’t have to be. This guide explores the different types of employee benefits, what’s required of you as an employer, why benefits are financially possible, and how to get started.

In This Article

At the core of every small business lies a drive for success—a goal that transcends the quality of products or services and deeply involves the team that powers its operations.

The strength of a business's workforce is fundamental, underscoring the importance of not just assembling a skilled team but also understanding and addressing their diverse needs. As a business owner, you have the power to address your team’s needs by offering employee benefits.

The bedrock of benefits: More than just perks

An employee benefits package extends beyond mere perks to reflect your business's values and commitment to its team. These benefits—encompassing health plans, retirement plans, wellness programs, and more—are not just tools for enhancing employee satisfaction; they are vital components in fostering a supportive and engaged workplace culture.

Healthcare for Employee Well-being

By offering healthcare benefits, perhaps the most common employee benefit, you can significantly impact your employees' lives, ensuring access to necessary medical care without the looming fear of financial ruin.

Futureproofing through Retirement Planning

Retirement benefits, often perceived as the domain of larger corporations, are equally within reach for small businesses like yours. Options like SIMPLE IRAs and 401(k) plans not only empower employees to secure their future but also offer tax advantages that can bolster your business's bottom line.

Cultivating a Culture of Wellness

Wellness programs, from in-office fitness initiatives to mental health support, underscore a holistic approach to employee benefits. These programs echo a growing recognition of the interplay between physical well-being and workplace productivity, presenting an opportunity for your business to invest in their employees' health in broad and impactful ways.

Explore

Different types of benefits

For small business owners, crafting an employee benefits package requires careful consideration and strategic planning. The size of your business, what industry you belong to, and your employees’ preferences can determine what benefits you decide to offer to your employees.

Health and Wellness Benefits

Health and wellness benefits are foundational to any comprehensive employee benefits package, aiming to support the physical and mental health of employees. These benefits range from medical, dental, and vision insurance, which cover essential health care needs, to wellness programs designed to promote healthy lifestyles and prevent disease.

As a business owner, you have the power to address your team’s needs by offering employee benefits.

Health

Coverage for medical expenses, often including prescription drugs, emergency care, and preventive services.

Dental

Coverage for dental care services such as cleanings, x-rays, fillings, and sometimes orthodontics.

Vision

Coverage for eye exams, prescription eyewear, and sometimes eye surgery.

Health savings accounts (HSAs) and flexible spending accounts (FSAs)

Accounts where employees can save pre-tax dollars for eligible healthcare expenses.

Wellness programs

Initiatives aimed at promoting healthy lifestyles, such as gym membership discounts, smoking cessation programs, and stress management workshops.

Employee assistance programs (EAPs)

Confidential counseling and support services for personal and work-related issues.

Financial and Retirement Benefits

Financial security is a major concern for employees, and benefits in this category are designed to address those needs, both in the present and the future.

Retirement plans, such as 401(k)s and pensions, help employees save for their post-work years, often with the added boost of employer contributions. Life and disability insurance offer protection against unforeseen circumstances, ensuring financial stability. Additionally, tuition reimbursement programs support ongoing education and career development, further securing an employee's financial future.

- Retirement plans: 401(k) plans, pension plans, Savings Incentive Match Plan for Employees (SIMPLE) IRAs, and Simple Employee Pension (SEP) IRAs offer employees a way to save for retirement, often with employer contributions.

- Life insurance: Provides a monetary benefit to a designated beneficiary upon the employee's death, often at no cost to the employee for a basic policy.

- Disability insurance: Offers income protection to employees unable to work due to a disability. This includes both short-term and long-term disability insurance.

- Tuition reimbursement: Financial assistance for further education relevant to the employee's job or career path.

Leave and Time-Off Benefits

Time away from work is crucial for employee satisfaction and mental health. Leave and time-off benefits, including paid time off (PTO), family and medical leave, and parental leave, provide employees with the time needed to rest, recover, and attend to personal matters.

- Paid time off (PTO): Can include vacation days, sick leave, and personal days. PTO policies vary widely among employers.

- Family and medical leave: Unpaid, job-protected leave for specified family and medical reasons, with continuation of group health insurance coverage, as mandated by the Family and Medical Leave Act (FMLA) in the U.S.

- Parental leave: Paid or unpaid time off for the birth or adoption of a child. This is beyond what's required by FMLA in some states.

- Sabbaticals: Extended leave that may be offered after a certain period of service, often unpaid but with the guarantee of a job upon return.

Work-life balance and flexibility

In addition to leave and time-off, benefits that encourage work-life balance, such as flexible working hours and remote work opportunities, empower employees to design a work schedule that fits their lifestyle. Childcare assistance, whether through on-site facilities or financial support, helps employees manage their family responsibilities alongside their career.

- Flexible Working Hours: Options such as flextime, compressed workweeks, or shift work to accommodate personal needs and preferences.

- Remote Work Opportunities: The ability to work from home or other locations outside the traditional office setting, either full -time or part- time.

- Childcare Assistance: Benefits that help employees with their childcare needs, such as on-site childcare facilities, childcare subsidies, or access to a dependent care flexible spending account.

Professional development

Investing in employees' growth and development is beneficial both for the individuals and the business. Professional development benefits, including training programs and career advancement opportunities, enable employees to acquire new skills, improve their job performance, and advance their careers. This not only contributes to personal fulfillment but also ensures the company has a skilled and motivated workforce ready to meet future challenges.

- Training and development programs: Opportunities for employees to acquire new skills or enhance existing ones, including workshops, courses, and seminars.

- Career advancement opportunities: Pathways for promotion and internal mobility that are communicated and accessible to employees.

Additional Perks and Miscellaneous Benefits

Beyond the core categories, a variety of additional perks and miscellaneous benefits can make a workplace more attractive. Employee discounts, transportation benefits, and relocation assistance are examples of perks that add extra value to the employment package.

- Employee discounts: Reduced prices on the company's products or services, or discounts arranged with other companies.

- Transportation benefits:

Subsidies or reimbursement for commuting costs, such as public transit passes, parking fees, or bike-to-work programs.

- Relocation assistance: Support for employees who are moving for work, covering expenses like moving costs and temporary housing.

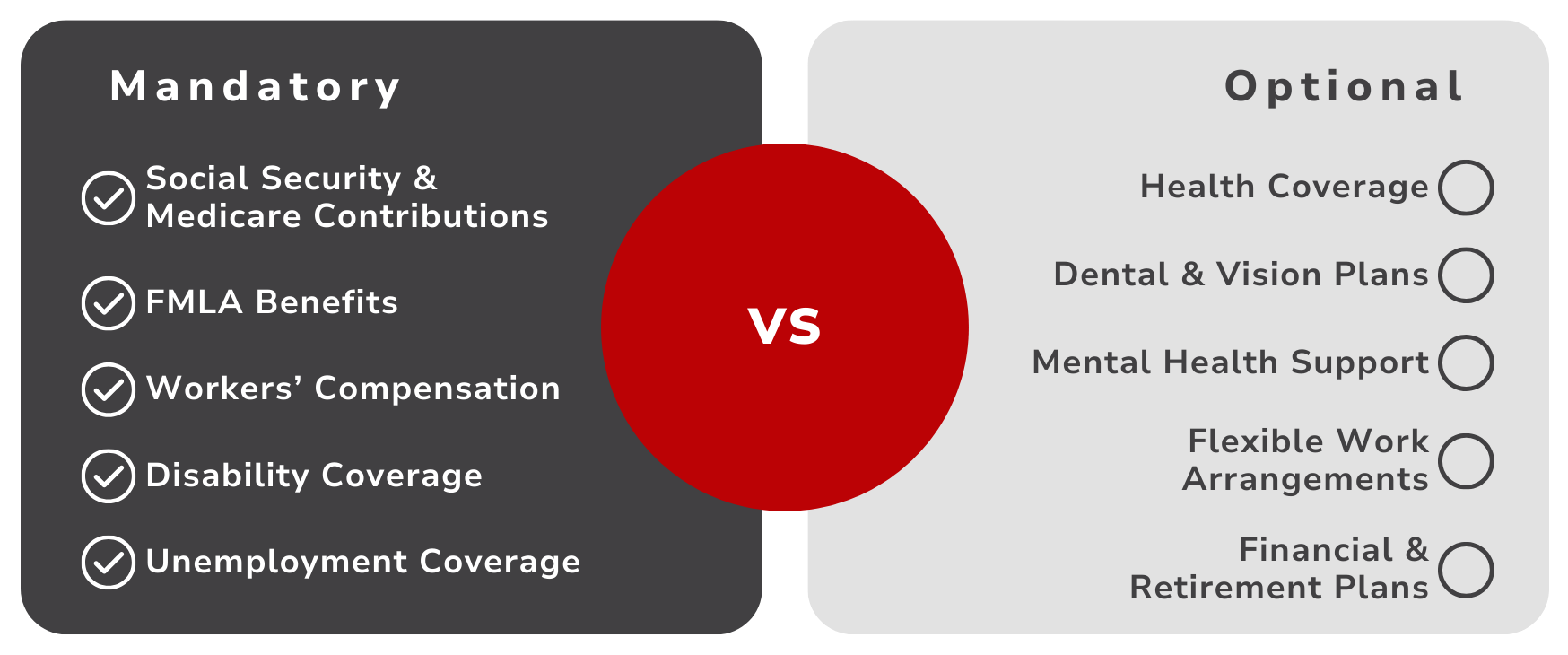

Understanding mandatory vs. optional benefits

Understanding which benefits are required by law versus those that are discretionary can help you make informed decisions that align with both your business objectives and your team’s needs.

Mandatory Benefits

Below is a list of benefits you are legally required to provide to your employees. It’s important to note that these requirements can vary depending on what state your business is located in.

- Social security and medicare contributions:

Employers are required to pay Social Security and Medicare taxes for their employees, matching the amounts withheld from employees' paychecks.

- Worker’s compensation insurance: This insurance provides benefits to employees who suffer job-related injuries or illnesses. While requirements can vary, having some form of workers' compensation coverage is generally mandatory across the United States.

- Unemployment insurance: Employers must pay into the state unemployment insurance program. This program provides temporary financial assistance to workers who have lost their jobs through no fault of their own.

- Family and medical leave (FMLA):

In the United States, the federal Family and Medical Leave Act (FMLA) requires covered employers to provide employees with unpaid, job-protected leave for specified family and medical reasons. However, FMLA applies to employers with 50 or more employees, so it may not affect the smallest businesses unless they are in states with more stringent requirements.

- Disability insurance: Some states require employers to provide short-term disability benefits. This is not a federal requirement, but states like California, New York, New Jersey, Rhode Island, and Hawaii have their own mandates.

Optional benefits

While understanding mandatory benefits is crucial for compliance, exploring optional benefits opens a realm of opportunity for small business owners to truly differentiate themselves as employers of choice. Optional benefits—ranging from health insurance for smaller entities, retirement savings plans, to wellness programs and more—offer a powerful tool to attract, retain, and motivate a talented workforce.

Compliance considerations

The employee benefits industry is fraught with legal intricacies, from mandatory offerings like social security contributions to the nuanced requirements of the Affordable Care Act (ACA). For small business owners, understanding these obligations is paramount if you choose to offer benefits, not just to ensure compliance but to build a foundation of trust and transparency within your team.

Understanding ERISA

The Employee Retirement Income Security Act (ERISA) is a federal law that sets standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans. If you offer retirement benefits or healthcare coverage regulated by ERISA, here are some things you need to know:

- Compliance: Ensure that your retirement plans, such as 401(k)s, and health plans comply with ERISA's requirements. This includes providing plan information to employees and establishing a claims and appeals process.

- Reporting and disclosure: ERISA requires plan administrators to report and disclose plan information to the federal government and participants. This includes the Summary Plan Description (SPD), which must be provided to participants and beneficiaries.

- Fiduciary responsibilities: If you're making decisions about how your employee benefits plan is run or how its funds are handled, you're seen as a fiduciary. Being a fiduciary means you have a critical duty to always act in the best interest of your employees and their families who are covered by the plan. You're expected to meet a high standard of care and honesty, ensuring the plan's assets are managed properly for the benefit of those participating in the plan.

If you're making decisions about how your employee benefits plan is run or how its funds are handled, you're seen as a fiduciary. Being a fiduciary means you have a critical duty to always act in the best interest of your employees and their families who are covered by the plan.

Implementing Section 125 Plans

If you decide to offer benefits to your employees, you will want to consider setting up a Section 125 plan. Section 125 will allow you to offer pre-tax benefit deductions to your employees—saving them and your business on taxes.

Any business, regardless of size, can offer a Section 125 plan. Here are important considerations:

- Types of cafeteria plans:

The most common types include Premium Only Plans (POPs), which allow for pre-tax benefit deductions, and Flexible Spending Accounts (FSAs), which let employees set aside pre-tax dollars for medical and dependent care expenses.

- Non-discrimination testing:

To ensure that benefits are offered equitably and not just to highly compensated employees or key employees, Section 125 plans must pass non-discrimination tests. Failure to pass these tests can result in penalties.

- Plan documents and employee communication: It's essential to have a written plan document outlining the benefits and operations of your Section 125 plan. You also need to effectively communicate plan options and rules to your employees.

Benefits of Offering a MEC plan

The Affordable Care Act (ACA) includes provisions that affect businesses with 50 or more full-time equivalent employees, such as the requirement to offer health coverage. If your business has 50 or more full-time employees or equivalents, there is a mandate under the ACA that requires you to offer healthcare coverage that meets Minimum Essential Coverage (MEC) requirements. Failure to do so may result in tax penalties.

As a small business owner, you aren’t subject to the Employer Shared Responsibility Payment if you have less than 50 full-time employees. However, you may still want to offer health coverage that meets MEC requirements because it ensures that your team has access to preventive services, treatments, and procedures that are essential for maintaining their health.

Budget and financial considerations

While the prospect of offering benefits may seem financially daunting, the reality is more encouraging. Strategic planning and leveraging tax advantages can make offering benefits more attainable than many small business owners realize. Moreover, the investment in a robust benefits package can pay dividends in attracting talent and reducing turnover, ultimately contributing to your business's success and sustainability.

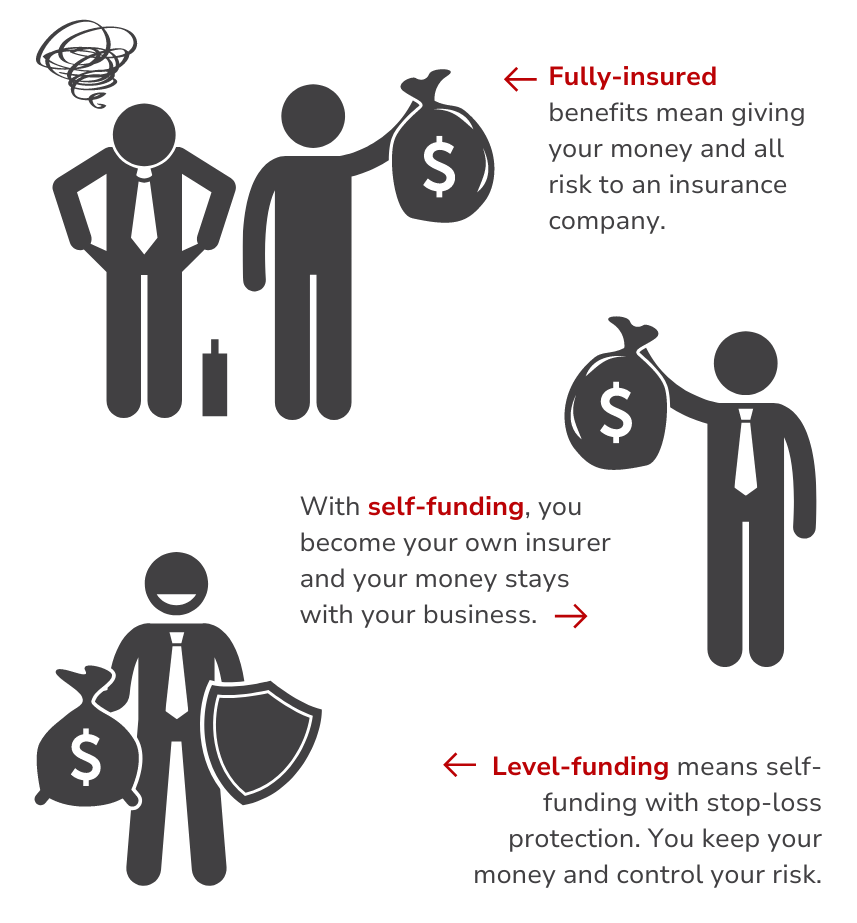

Funding Options: Self-Funding vs. Fully-Insured

Understanding the various fund options for employee benefits can be a deciding factor on whether you choose to offer benefits. Selecting the right funding strategy is critical for balancing financial health with a competitive edge in employee benefits.

Self-funding, or self-insuring, is an option where businesses assume direct financial responsibility for the healthcare costs of their employees.

This approach offers more control over the benefits plan, and can potentially lead to cost savings by eliminating insurer profit margins and overhead costs.

Self-funding

Self-funding, or self-insuring, is an option where businesses assume direct financial responsibility for the healthcare costs of their employees. This approach offers greater control over the benefits plan, potentially leading to cost savings by eliminating insurer profit margins and overhead costs.

Self-funded plans require careful financial management and risk assessment, as you would be responsible for covering claims.

Level-funding

Level-funding is a type of self-funding with stop loss coverage attached. Like a self-funded plan, the employer assumes direct financial responsibility for the healthcare costs for their employees. However, part of the cost is paid towards having stop loss coverage.

Stop-loss coverage is added protection for business owners who choose the self-funding route. It means that if health claims exceed the employer's claims fund, this coverage helps to cover the excess, ensuring that one large claim doesn't drain the employer's finances.

Fully-insured

In contrast, fully insured plans involve purchasing health insurance from an insurance provider, who assumes the risk. This approach does offer a certain level of cost predictability, with premiums set for the year, and it's generally simpler to handle than managing a self-funded plan. However, for small businesses, the higher costs associated with these plans—often due to the insurance provider's markups—can make them a less feasible option.

While the stability and straightforward nature of fully insured plans are appealing, small business owners are increasingly considering the potential benefits of self-funding or level-funding to better control expenses.

Harnessing Tax Credits to Ease Financial Burdens

Tax credits and tax-advantaged accounts are additional tools available to small business owners that reduce the overall cost burden of health benefits but also add substantial value to your benefits package.

Tax-Advantaged Accounts: HSAs and FSAs

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) offer tax advantages for both employers and employees. Contributions made by the business to these accounts are tax-deductible, and employees benefit from tax-free contributions and withdrawals for qualified medical expenses. These accounts not only provide financial benefits but also enhance the overall value of your health benefits package.

Managing Costs with Voluntary Benefits

Offering voluntary benefits—additional benefits that employees can choose to purchase at group rates—can enrich your benefits package without significantly impacting your budget. These benefits, which are explained in an earlier section of this guide, are typically paid for by the employee through payroll deductions.

For small businesses, voluntary benefits offer a cost-effective way to provide a more comprehensive benefits package and meet diverse employee needs.

Implementing and managing employee benefits

Setting up and managing a robust employee benefits package can be a complex but rewarding endeavor for small business owners. As you go through this journey, it's crucial to keep several key factors in mind to ensure that your benefits strategy aligns with both your business objectives and the needs of your employees.

From selecting the right mix of benefits to understanding the legal and financial implications, each decision plays a vital role in the success of your benefits program.

Additionally, the administrative aspect of efficiently managing these benefits introduces complexities that may initially seem challenging to navigate for many small businesses.

This is where the advantages of partnering with a third-party administrator (TPA) like Planstin comes into play. We can offer valuable assistance in not only simplifying the complexity associated with benefits administration but also in optimizing your benefits package to ensure it's both competitive and compliant.

The Advantages of Partnering with Planstin

Partnering with a third-party administrator such as Planstin brings a multitude of advantages to the table:

- Expertise and compliance:

Our professionals ensure that your benefits program not only meets regulations but also is finely tuned to align with your business' specific needs. We can help you craft and administer benefits that are valuable for you and your team.

- Administrative efficiency: We can help lighten the load of benefits administration through our comprehensive support— encompassing enrollment, management, and adherence to compliance requirements. Our services allow you to dedicate more time and resources to your primary business operations.

- Tailored solutions: We collaborate with you to craft a benefits package that perfectly caters to the distinctive needs of your employees, thereby boosting satisfaction and loyalty among your team.

- Cost-effective benefits: With our unique solutions, like pairing a preventive health plan that meets MEC requirements with a HealthShare membership, we can save you more money compared to traditional health plans. This allows you to focus on growing your business.

Your partner in overcoming obstacles in benefits administration

Learning about employee benefits and implementing them can be a daunting task for small business owners. Yet, the importance of constructing a comprehensive and compliant benefits package cannot be overstated. It's a crucial factor in attracting and retaining the talent that will drive your business forward.

If you feel overwhelmed at the thought of offering benefits and don’t know where to start, you’re not alone. Partnering with us allows you to leverage our expertise and resources, ensuring that you don’t have to go through this process alone. Our goal is to guide you to better benefits through crafting and administering benefits that are flexible, budget-friendly, and simple to understand.

If you’re interested in learning more about how we can help your small business, visit planstin.com to book a free call with our team.

If you’re a small business owner looking for benefits designed to fit your needs, there are solutions for you.

Explore

SUGGESTED FOR YOU

I WANT TO...

LOGIN

CLAIM INFORMATION

Payer ID: 65241

Planstin Administration

P.O. Box 21747

Eagan, MN 55121

© 2023 Planstin Administration - All Rights Reserved