What is Minimum Value? Understanding Minimum Value Plans

Reduce turnover, build employee loyalty, and maintain compliance with MVP options.

Navigating the Affordable Care Act can be a daunting task for business owners; But it doesn’t have to be. Let's look at the ACA’s minimum value standards, potential penalties for non-compliance, and why businesses should consider offering minimum value plans (MVPs).

What is a minimum value plan (MVP)?

The Affordable Care Act (ACA) established baseline criteria for employer-backed health benefits. Among these criteria is the minimum value requirement. To qualify as providing “minimum value,” a health plan needs to cover a minimum of 60% of the overall plan costs and include a broad range of medical services, including inpatient and outpatient surgery, maternity care, and emergency and urgent care. Basically, the plan needs to foot the bill for the majority of the insured medical costs, and the employee pays the rest through deductibles, copays, and coinsurance.

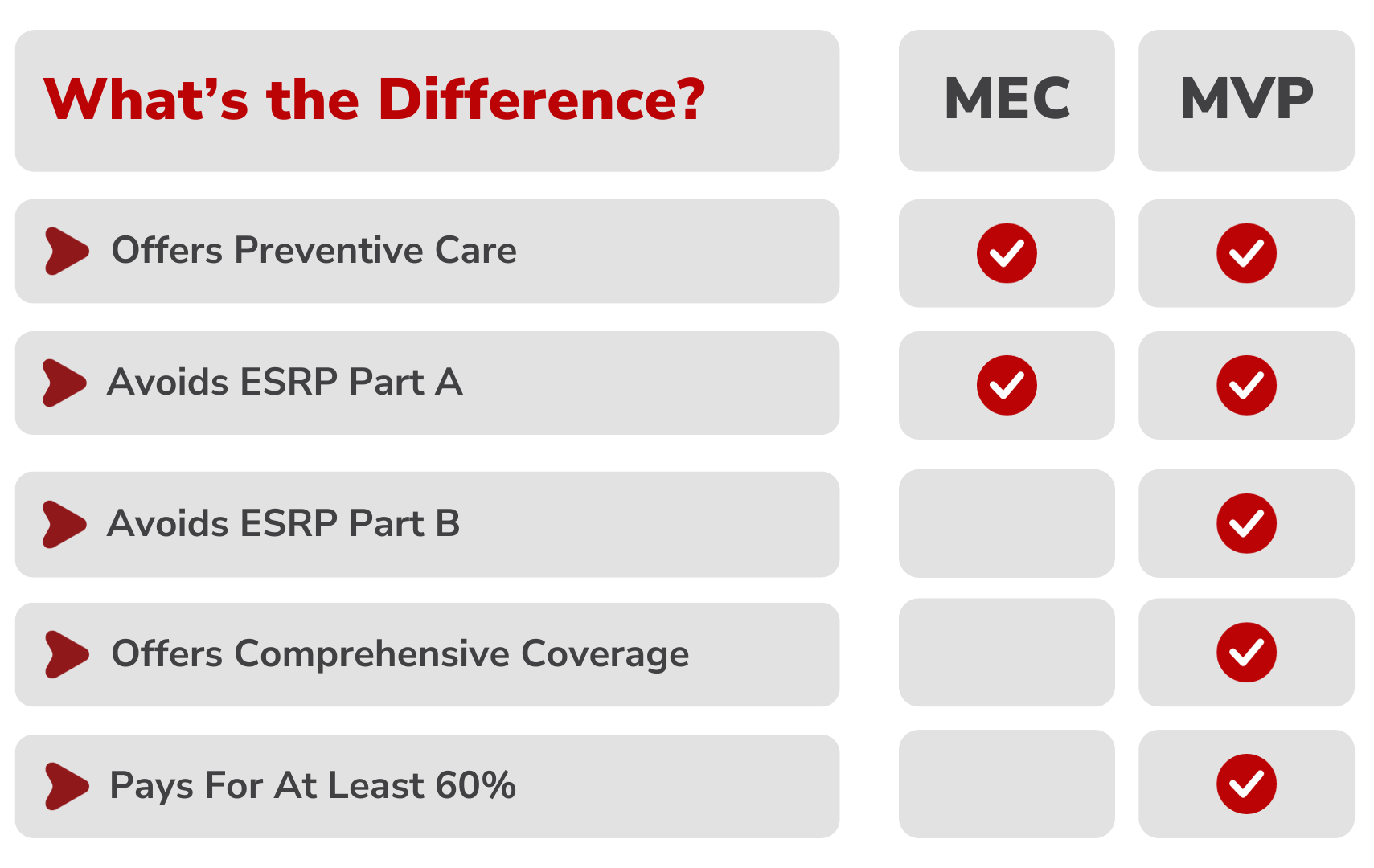

How are MVP and MEC different?

In a previous post we covered MEC plans and why offering qualifying healthcare coverage is crucial for large employers. Minimum essential coverage plans are only required to cover preventive care and follow the requirements of the ACA’s extended patient bill of rights. MVP benefits are similarly important for large employers to consider; however, as stated above, they go beyond minimum essential coverage by including much more substantial coverage for comprehensive healthcare services.

The MEC and MVP thresholds are both important because meeting them helps employers avoid some serious tax penalties. While meeting MEC requirements will help an applicable large employer (ALE) avoid the Employer Shared Responsibility-Part A penalty, to avoid Part B of the penalty, employer-sponsored benefits must include an MVP option.

The Employer Shared Responsibility Penalty

If an ALE’s employer-sponsored health plan does not meet the minimum value requirements, employees may qualify for premium tax credits and be eligible to receive coverage in the Marketplace. If this happens, the employer may be penalized through the Employer Shared Responsibility – Part B. In 2024, the Employer Shared Responsibility-Part B fine is $4,460 per year, per employee.

The penalty is assessed on a case-by-case basis, meaning you may be penalized if just one employee declines your benefits and turns to the Marketplace for subsidized coverage. However, you are only penalized for each employee who receives subsidized coverage, not for your entire employee population.

While potential tax penalties serve as a strong incentive for offering an MVP option, sponsoring workplace benefits that meet ACA minimum value standards can help you in other important ways.

Are you an ALE?

All ALEs are subject to the Employer Shared Responsibility. But, how do you know if you are one?

An ALE has an average of at least 50 full-time employees. However, the way the government outlines full-time employees may differ from how your organization defines full-time status. Furthermore, calculating the exact number of full-time employees can get complex since part-time employee hours are factored in when assessing ALE status.

We recommend using the Taxpayer Advocate Service’s ESRP Estimator, reading the IRS page on the topic, or asking a professional for help when determining whether you are considered an ALE.

Why even small businesses should consider MVP options

Access to a minimum value plan means your employees, and their families, have more substantial coverage they can rely on. With better coverage they will be better able to tackle health challenges that come their way throughout the working year. Your employees will be healthier, and they will have you to thank for it.

Besides the fact that employees want access to better benefits, the MVP standard is designed to ensure that people have access to quality health coverage. The penalties for non-compliance are in place to incentivize businesses to offer adequate coverage to their employees. By understanding and meeting these requirements, large employers contribute to the health and wellbeing of their employees—something that businesses of all sizes can benefit from.

Employee retention is a serious issue in the current job market, and employees stay longer when they’re healthy and happy. Offering quality, comprehensive benefits helps attract top talent as well as retain and motivate your employees. It also ensures your employees, and their families, are covered in the event of illness or injury—and they will have you to thank for providing that coverage.

How Planstin works with MVP

Understanding and complying with the ACA’s requirements can be a burden for a growing business. It involves staying up to date with the latest changes, accurately calculating affordability based on safe harbors, and ensuring that your healthcare benefits meet necessary standards. While this may seem overwhelming, remember that you’re not alone. There are plenty of resources available to help you navigate these complexities. Professional advisors, industry peers, and companies like Planstin can provide valuable service and guidance.

Offering benefits doesn’t have to be a Herculean task reserved only for Fortune 500 companies—you can do it too. We are here to help you make it happen. Let us help you around whatever barriers stand between your business and offering benefits.

To learn more:

Contact us @ 888-920-PLAN

Read our blog on MEC plans

Review our MVP options

Legal disclaimer: This is not legal advice. For questions regarding your specific situation, please consult an attorney.

Explore

SUGGESTED FOR YOU

I WANT TO...

LOGIN

CLAIM INFORMATION

Payer ID: 65241

Planstin Administration

P.O. Box 21747

Eagan, MN 55121

© 2023 Planstin Administration - All Rights Reserved